How To Get New Chip Based Card

Updated on Saturday, 20 September 2025 - 4:40pm

To expand image

To expand image

To expand image

To expand image

.jpg)

To expand image

To expand image

Eligibility

- You must have a savings or current account in the bank.

- Your account must be KYC updated (Aadhaar, PAN, ID + address proof).

- Minimum age: 18 years (some banks give minor cards from 10+ with parent’s permission).

- Residency: Both Indian residents and NRI/PIO customers are eligible. NRIs can apply for international cards linked to NRE/NRO accounts.

- For credit cards, you must have a stable income source and meet the bank’s income criteria.

Ways to Apply for a Chip-Based Card

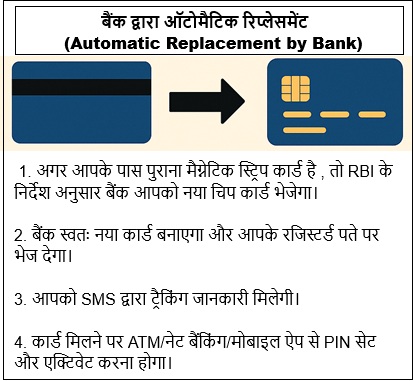

1. Automatic Replacement by Bank

(If you have an old magnetic stripe card)

- RBI instructed all banks to replace magnetic stripe cards with chip cards.

- Your bank checks your account and automatically generates a new card.

- The card is couriered to your registered address without your request.

- You get an SMS alert with tracking details.

- On delivery, activate and set PIN through ATM, NetBanking, or Mobile App.

2. Apply Through Internet Banking

- Login to your bank’s NetBanking portal.

- Go to e-Services / Card Services / ATM-Debit Card Services.

- Select Request New Debit Card or Replace Debit Card.

- Choose card type:

- Domestic (only India)

- International (for foreign usage)

- Contactless (tap & pay)

- Confirm your registered address.

- Pay charges if applicable (₹100–₹300 for replacement).

- Submit the request.

- Bank dispatches card in 7–10 working days.

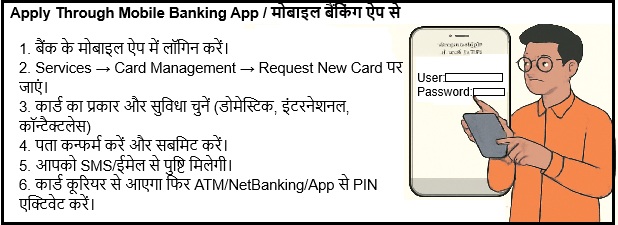

3. Apply Through Mobile Banking App

- Login to your bank’s official Mobile App.

- Tap on Services → Card Management → Request New Card.

- Select debit/credit card type and features (domestic, international, contactless).

- Confirm delivery address and submit.

- You get SMS/email confirmation.

- Card arrives by courier

- Activate via ATM / App / NetBanking.

- Card dispatched to registered address in 3–5 working days.

4. Apply at Bank Branch (Offline)

- Visit your home branch with account passbook and ID proof.

- Ask for the Debit Card Application Form.

- Fill in details: Account number, Name, Address, Card type.

- Attach self-attested ID proof (if asked).

- Submit form to branch staff.

- Bank verifies KYC and processes request.

- Card dispatched to registered address (usually 7–10 days).

- Collect welcome kit

- Activate PIN at ATM or online.

.jpg)

5. Apply Through Customer Care / Phone Banking

- Call your bank’s toll-free customer care number.

Public Sector Banks

Sr No. Bank Contact No. 1 Bank of Baroda 18005700 2 Bank of India 18001031906 3 Bank of Maharashtra 18001022636 4 Canara Bank 18001030 5 Central Bank of India 18003030 6 Indian Bank 18001700 7 Indian Overseas Bank 18004254445 8 Punjab and Sind Bank 18004198300 9 Punjab National Bank (PNB) 18001800, 18001802222, 18001032222 10 State Bank of India (SBI) 1800112211 11 UCO Bank 18001030123 12 Union Bank of India 18002082244 Private Sector Banks

Sr No. Bank Contact No. 1 Axis Bank 18002095577 2 Bandhan Bank 18002588181 3 City Union Bank 044-71225000 4 DCB Bank 02268997777 5 Dhanlaxmi Bank 18004251747, 044-42413000 6 Federal Bank 18004251199, 18004201199 7 HDFC Bank 18002600, 18001600 8 ICICI Bank 18001080, 18002662 9 IDBI Bank 18002094324 10 IDFC First Bank 180010888 11 IndusInd Bank 18602677777 12 Jammu & Kashmir Bank 18008902122 13 Karnataka Bank 18004251444 14 Karur Vysya Bank 18602581916 15 Kotak Mahindra Bank 18602662666 16 Nainital Bank 18001804031 17 RBL Bank 02261156300 18 South Indian Bank 18004251809, 18001029408 19 Tamilnad Mercantile Bank 18004250426 20 Yes Bank 18001200 - Authenticate with account details / PIN / OTP.

- Ask for replacement/new chip card.

- Customer care executive confirms address and submits request.

- Card dispatched to registered address.

- On receiving card, generate PIN via ATM/IVR/NetBanking.

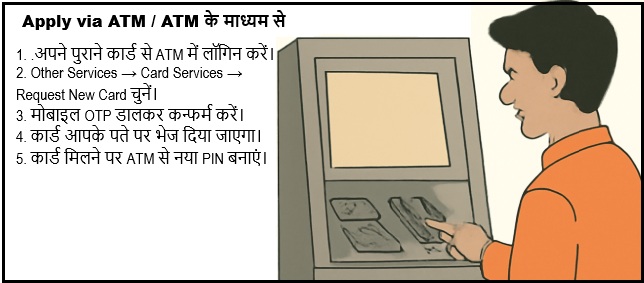

6. Apply via ATM (Available in Some Banks)

- Visit nearest ATM.

- Insert your existing ATM/debit card.

- Select Other Services → Card Services → Request New Card.

- Enter mobile OTP to confirm.

- Request gets registered → Card delivered to your address.

- After receiving card, activate with new PIN at ATM.

7. Special Cases

NRI Customers

- Apply via NRI Internet Banking or call NRI helpline.

- Can also request through assigned Relationship Manager.

- Card couriered to overseas address (or Indian address if allowed).

Jan Dhan Account Holders

- Rupay EMV chip card usually issued at account opening.

- If lost/damaged, apply at branch for replacement (free or nominal charges).

After Receiving Any Card

- Open the welcome kit and check card details.

- Generate PIN:

- ATM: Insert card → Set/Change PIN → Enter OTP → Set 4-digit PIN.

- NetBanking/Mobile App: Use Generate PIN option.

- Do a test transaction (balance enquiry or small withdrawal).

- Register for SMS/email alerts for safety.