Safety Tips For Bank Customers (To Avoid Fraud)

Updated on Tuesday, 6 January 2026 - 4:37pmKeep These Important Points In Mind For Safe Banking

1. Protect Your Personal Details

- Never share PIN, OTP, CVV, internet banking password, or UPI MPIN with anyone.

- Banks and RBI never ask for such details on phone, SMS, or email. Always verify requests by directly contacting your bank.

2. Secure Your Devices

- Use official banking apps only from Google Play Store/Apple App Store.

- Keep your phone and computer updated with security patches/antivirus.

3. Use Strong and Unique Passwords

- Change passwords regularly.

- Do not use simple combinations like birthdate, mobile number, or "1234".

- Enable Two-Factor Authentication (2FA) for extra protection.

4. Verify Messages and Links

- Do not click on unknown links in SMS/emails.

- Type the bank's official website URL manually.

- Ensure the site starts with "https://"and shows a padlock icon before entering details.

5. Beware of Fake Calls (Vishing) and Fake SMS (Smishing)

- Do not share personal details over the phone, Fraudsters may pose as officials.

- If in doubt, hang up and call your bank's official number to verify the request.

6. Safe ATM and POS Use

7. Monitor Accounts Regularly

- Check SMS/email alerts and bank statements frequently.

- Immediately report unauthorized transactions.

8. Avoid Public Wi-Fi for Banking Transactions

- Do not access bank accounts on public Wi-Fi.

- Turn off Wi-Fi when not in use to avoid automatic insecure connections.

9. Be Cautious with Social Media

- Do not share personal or financial information on social media.

- Fraudsters may use such details to impersonate you.

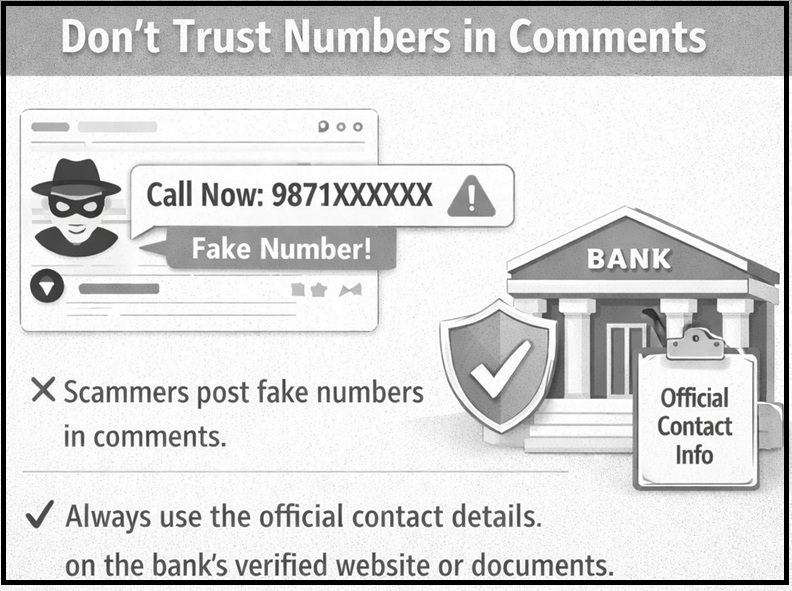

10. Don't Trust Numbers in Comments

- Do not trust the number shown in the comments section of websites because these numbers are often commented by fraudsters.

- A well-informed customer does not rely on such numbers, always refer to the official contact details provided on the bank's verified website or official documents.

11. Report Immediately in Case of Fraud

- Call 1930 (National Cyber Crime Helpline).

- You may file a complaint on National Cyber Crime Reporting Portal (NCRP) by following the prescribed Procedure To File A Complaint .

- Inform your bank immediately to freeze/secure the account.