Post Office Saving Schemes Procedure

Updated on Saturday, 27 December 2025 - 4:16pm

Organization:

India Post Toll free Number(s):

- 1800 266 6868 (For Customer Support, 9am-6pm, Except Sunday/Gazetted Holidays)

- 1800 425 2440 (For ATM/ Debit Card, Mobile/Internet/SMS Banking Related Grievances)

Website:

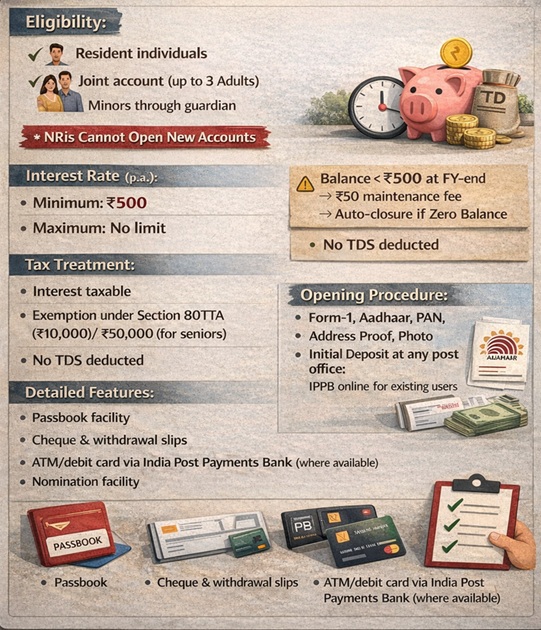

Official Website 1. Post Office Savings Account

- Eligibility:

- Resident individuals, Joint account (up to 3 adults), Minors through guardian.

- NRIs cannot open new accounts.

- Interest Rate: 4.0% per annum (credited quarterly)

- Deposit Limits:

- Minimum: ₹500

- Maximum: No limit

-

NOTE: Balance <₹500 at FY-end → ₹50 maintenance fee → auto-closure if zero.

NOTE: Balance <₹500 at FY-end → ₹50 maintenance fee → auto-closure if zero.

- Tax Treatment:

- Interest is taxable

- Exemption under Section 80TTA (₹10,000) / 80TTB (₹50,000 for seniors)

- No TDS deducted

- Opening Procedure: Form-1, Aadhaar/PAN, address proof, photo, initial deposit at any post office; IPPB online for existing users.

- Detailed Features:

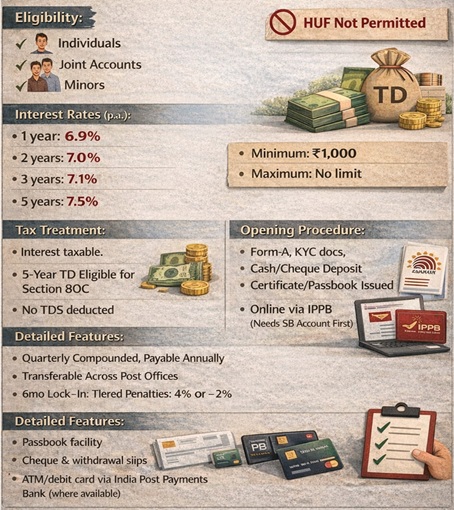

2. National Savings Time Deposit (TD)

- Eligibility:

- Individuals, Joint accounts, Minors.

- HUF not permitted

- Interest Rates (p.a.):

- 1 year: 6.9%

- 2 years: 7.0%

- 3 years: 7.1%

- 5 years: 7.5%

- Deposit Limits:

- Minimum: ₹1,000

- Maximum: No limit

- Tax Treatment:

- Interest is taxable.

- 5-year TD eligible for Section 80C

- Opening Procedure: Form-A, KYC documents , cash/cheque deposit; certificate/passbook issued.

- Online opening: Online via IPPB (needs SB account first)

- Detailed Features:

- Quarterly compounded, payable annually

- Transferable across post offices

- If closed between 6 months to 1 year → interest is paid at the Post Office Savings Account rate.

- If closed after 1 year (for 2 or 3year TD) → interest is paid at the TD rate minus 2% for completed years.

- 5-year TD can be closed only after 4 years, interest paid at Savings Account rate.

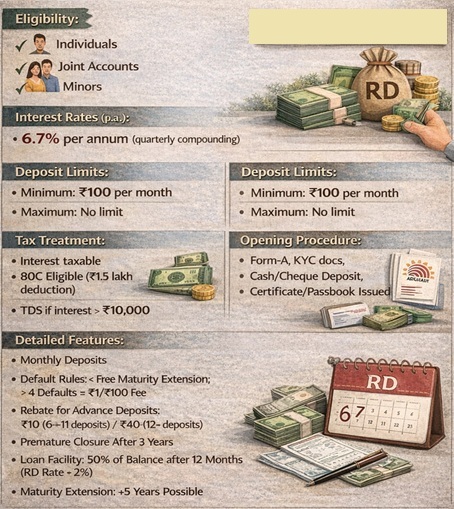

3. National Savings Recurring Deposit Account(RD)

- Eligibility: Individuals, joint accounts, minors

- Interest Rate: 6.7% per annum (quarterly compounding)

- Deposit Limits:

- Minimum: ₹100 per month

- Maximum: No limit

- Tax Treatment:

- Interest is taxable. No Section 80C benefit.

- Opening Procedure: Form-A, first deposit, monthly by 15th (or month-end); KYC required..

- Detailed Features:

- Monthly deposits

- Default Rules: up to 4 missed deposits: Free maturity extension, more than 4 missed deposits: ₹1 per ₹100 per month of default charged.

- Rebate for advance deposits: ₹10 (6-11 deposits) / ₹40 (12+ deposits).

- Premature closure after 3 years

- Loan facility: 50% of balance after 12 months (RD rate +2%)

- Maturity Extension: +5 years possible

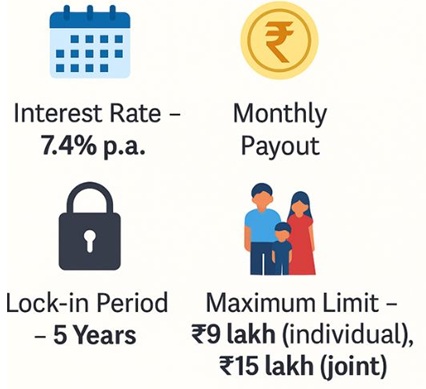

4. Post Office Monthly Income Scheme Account(MIS)

- Eligibility: Individuals and joint accounts

- Interest Rate: 7.4% per annum (paid monthly)

- Deposit Limits:

- Minimum: ₹1,000

- Maximum: ₹9 lakh (single), ₹15 lakh (joint).

- Tax Treatment:

- Interest is taxable, No Section 80C benefit.

- Opening Procedure: Form-A, ID proofs, deposit; link savings for payouts.

- Detailed Features:

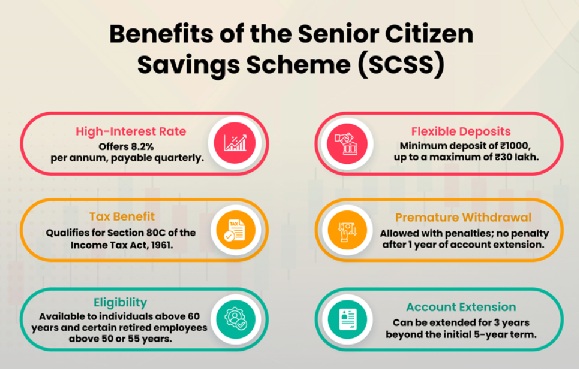

5. Senior Citizens Savings Scheme Account(SCSS)

- Eligibility:

- 60 years and above, 50 years and above (Defence personnel), joint with spouse only but first holder must be the senior citizen.

- 55-60 VRS retirees (within 3 months of benefits)

- Interest Rate: 8.2% per annum

- Deposit Limits:

- Minimum: ₹1,000

- Maximum: ₹30 lakh

- Tax Treatment:

- Investment eligible for Section 80C

- Interest is taxable

- ₹50,000 limit is exemption under 80TTB

- TDS applicable if interest exceeds ₹50,000 in a financial year (unless Form 15G/15H submitted)

- Opening Procedure: Form-A + retirement proof (for 55+), age proof, at designated branches.

- Detailed Features:

6. Public Provident Fund Account(PPF)

- Eligibility: Resident individuals (No Joint Accounts).

- Interest Rate: 7.1% per annum.

- Deposit Limits:

- Minimum: ₹500 per year

- Maximum: ₹1.5 lakh per year

- Tax Treatment:

- EEE category (investment, interest, maturity tax-free)

- Opening Procedure: Form-1, KYC, initial deposit.

- Detailed Features:

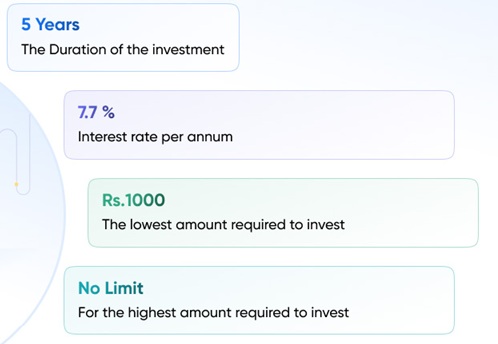

7. National Savings Certificates (VIII Issue) (NSC)

- Eligibility: individuals, joint holders, minors

- Interest Rate: 7.7% per annum

- Deposit Limits:

- Minimum: ₹1,000

- Maximum: No limit

- Tax Treatment:

- Investment eligible under Section 80C

- Interest is taxable (except last year reinvested amount)

- Opening Procedure: Purchase certificate with KYC at post office.

- Detailed Features:

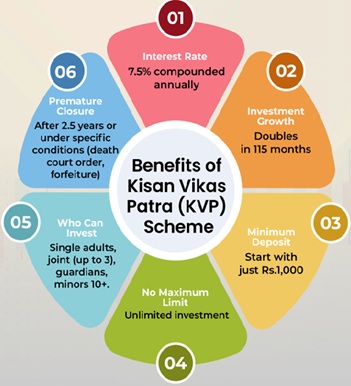

8. Kisan Vikas Patra (KVP)

- Eligibility: Individuals, joint, minors.

- Interest Rate:7.5% (money doubles in ~115 months)

- Deposit Limits:

- Minimum: ₹1,000

- Maximum: No limit

- Tax Treatment:

- No Section 80C benefit.

- Interest fully taxable

- Opening Procedure: Buy certificate with KYC.

- Detailed Features:

9. Sukanya Samriddhi Account(SSA)

- Eligibility: Girl child under 10 years (guardian opens; max 2 girls per family).

- Interest Rate: 8.2% per annum

- Deposit Limits:

- Minimum: ₹250 per year

- Maximum: ₹1.5 lakh per year (deposits allowed for first 15 years).

- Tax Treatment:

- EEE category

- Opening Procedure: Form at post office, birth certificate, KYC.

- Detailed Features:

- Maturity after 21 years

- Partial withdrawal allowed after age 18 or after passing Class 10.

10. Mahila Samman Savings Certificate (MSSC)

- Eligibility: Women/girls (guardian for minors) (Scheme Ends : 31.03.2025).

- Interest Rate: 7.5% per annum (quarterly compounded)

- Deposit Limits:

- Minimum: ₹1,000

- Maximum: ₹2 lakh total across all MSSC accounts, 3-month gap between accounts

- Tax Treatment:

- Interest is taxable, TDS if >prescribed limit (15G/H exempt)

- No Section 80C benefit

- Opening Procedure: Form with KYC at post office.

- Detailed Features:

- 2-year tenure

- 40% withdrawal after 1 year, Premature closure after 6 months (-2%).

11. PM CARES for Children Scheme (2021)

NOTE: Scheme closed for new accounts post-28.02.2022.

NOTE: Scheme closed for new accounts post-28.02.2022.

- Eligibility: Children under 18 who lost parents/legal guardian to COVID-19 (11.03.2020 - 28.02.2022)

- Interest Rate: MIS rate on ₹10 lakh (monthly stipend till age 23)

- Deposit Limits: ₹10 lakh lump-sum (from PM CARES Fund at age 18)

- Tax Treatment: Amount received under PM CARES for Children Scheme is fully tax-exempt under Section 10(46)

- Opening Procedure: District Magistrate opens as joint holder with Form + death certificates.

- Detailed Features:

- Converts to single account at age 18

- Monthly income till age 23

- District Magistrate operates till age 18

Parent Article:

Comments

surir postoffice wale misbehave karte hai aur abuse use karte

Dear sir,

this side Vishnu Sharma from Meerpur mant mathura up 281205 my post office in surir

I am going to post office around 2 month ago for Aadhar card registration but office called me please came after two month then yesterday at 25/06/2022 we going for a speed post but I check that ne Aadhar card generate I called new Aadhar card registration start or not he call me new registration are start i called we have two child 1 year and 3 year so we generate new Aadhar he called me go to your home and take your child then came we generate new Aadhar but then after came with child he called no new Aadhar generate and Omprakash misbehavior with me and my child and my wife .

i am have at 3 pm but no new generate and abuse me .

please register complaint against post officer. I am herbals request to you .